What if we told you that investing just ₹10,000 per month could make you a crorepati—not once, but eleven times over?

That’s not clickbait—it’s a real historical instance.

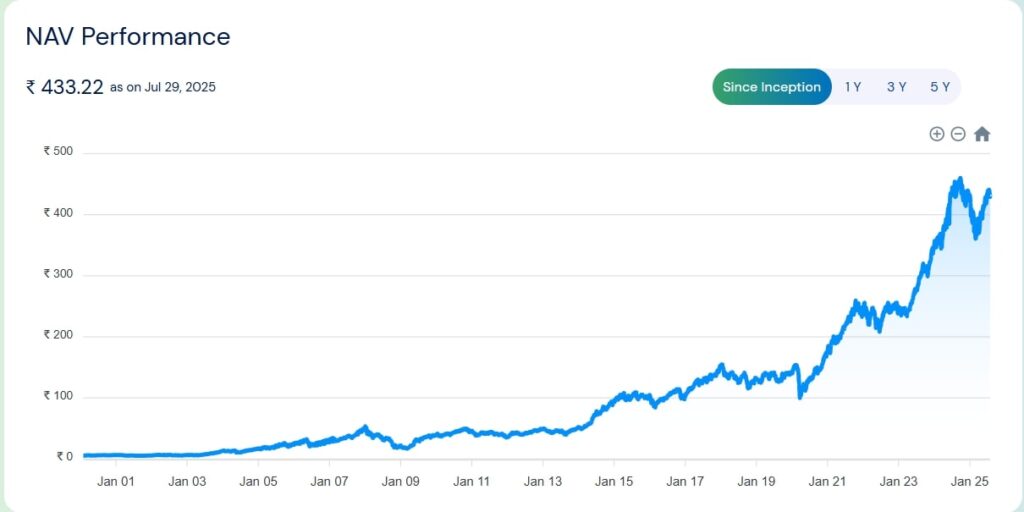

A Systematic Investment Plan (SIP) of ₹10,000 in the Tata Mid Cap Fund – Regular Plan (Growth Option), if started 31 years ago, would be worth ₹11.26 Crores today (as of July 2025).

In this blog, we will decode this journey, the mechanics behind this compounding marvel, and how investors can draw real, practical investing lessons from this inspiring example.

1. 📌 Introduction: A SIP Story That Stuns

Most people underestimate how small consistent investments can build substantial wealth over time.

The Tata Mid Cap Fund’s growth from ₹10,000 per month SIP to over ₹11.26 Cr in three decades is a rare but real showcase of:

- Long-term discipline,

- Equity’s potential,

- The miracle of compounding,

- And the sheer power of patience.

Let’s break this down in detail.

2. 🏦 Tata Mid Cap Fund: Overview & Legacy

The Tata Mid Cap Growth Fund is one of the oldest mid-cap mutual funds in India. Launched in 1994, this fund primarily invests in mid-sized companies with high growth potential.

Key Attributes:

- Fund House: Tata Mutual Fund (among the most respected in India)

- Fund Category: Mid Cap

- Benchmark: Nifty Midcap 150 TRI

- Inception Date: July 1994

- Fund Manager: Satish Chandra Mishra

Investment Philosophy:

The fund follows a bottom-up stock-picking approach, focusing on quality businesses with scalable growth models and competent management.

3. 🧠 Understanding the Power of Compounding

Compounding is the process by which the returns earned on your investments start generating returns of their own. Over long durations, the snowball effect is dramatic.

A ₹10,000 monthly SIP over 31 years equals:

- Total invested: ₹37.20 Lakhs (₹10,000 x 12 months x 31 years)

- Final Value: ₹11.26 Crores

- XIRR (Annualized Return): ~18.26%

This is not magic. It’s math + time + discipline.

4. 📊 SIP Math: How ₹10,000 Became ₹11.26 Crores

Let’s break the math down further.

| Period | Total Investment | Fund Value | XIRR |

| 31 years | ₹37.2 Lakhs | ₹11.26 Crores | ~18.26% |

If you had tried to time the market and missed the best years, your final corpus would’ve been much smaller. The investor who stayed invested throughout, through the dot-com bust, the 2008 crisis, demonetization, the COVID crash, and multiple elections, reaped the full reward.

5. 📈 Mid Cap Advantage: The Wealth Creation Engine

Mid Cap companies are often in the sweet spot—not as risky as small caps, yet more agile than large caps.

Why Mid Caps Work:

- Faster earnings growth

- Less research coverage (inefficiencies = opportunity)

- Ability to scale

However, this comes with higher volatility, which can make short-term investors anxious. That’s why SIP + long-term holding is the best way to tap mid-cap potential.

6. 🔁 Volatility vs Vision: Lessons in Staying Invested

Equity investing isn’t a smooth road. The investor in the Tata Mid Cap Fund saw:

- Sharp corrections

- Underperformance periods

- Market pessimism

Yet, by staying the course:

- Their ₹10,000 SIP kept buying more units during dips

- Rupee cost averaging worked beautifully

- The outcome was wealth multiplication beyond expectations

Key Lesson:

Volatility is not risk—selling due to fear is.

7. 📉 Real Returns vs Nominal Hype

Many people see ₹11.26 Cr and think: “Will that buy as much 30 years later?”

Valid question.

Let’s factor in inflation.

If inflation averaged ~6%, the real value of ₹11.26 Cr would be around ₹1.8–2.0 Cr in today’s money.

But:

- ₹2 Cr in today’s terms is still life-changing.

- And this was from just ₹10,000 per month.

The message? Even after inflation, long-term equity beats everything else.

8. ⚠️ Risks Involved in Mid Cap Investing

Mid cap funds are not risk-free. Let’s acknowledge what could go wrong:

- Higher price volatility

- Liquidity risks in smaller companies

- Business risk if fundamentals weaken

- Underperformance phases of 2–5 years

But these are manageable when:

- You invest via SIP

- Stay invested 10+ years

- Don’t panic during drawdowns

9. ⏳ Is It Too Late to Start Now?

Seeing ₹11.26 Cr after 31 years can feel like a missed train.

But here’s the truth: the next 30 years are still open.

We’re in an India that’s:

- Growing its GDP

- Seeing rising investor participation

- Moving toward consumption-led growth

- Witnessing a startup + manufacturing boom

If you start a SIP today:

- ₹10,000/month for 30 years @ 12% = ₹3.5 Cr

- @15% return = ₹6.7 Cr

- @18% return (like Tata Mid Cap historically) = ₹11 Cr+

It’s never too late. The earlier you start, the less you need to invest monthly.

10. 🛡️ The Mutual Fund Route to Long-Term Wealth

Mutual Funds simplify wealth creation for ordinary investors. Tata Mid Cap Fund is one such enabler.

Benefits of SIP in Mutual Funds:

- Disciplined investing

- Power of compounding

- Market volatility as an opportunity

- No need to time the market

Mid Cap Funds like Tata’s are ideal for:

- 10+ year goals

- Retirement

- Child’s education

- Passive wealth creation

11. 🧭 Final Thoughts: Time > Timing

The biggest takeaway from this SIP-to-crorepati story is:

You don’t need to be a market expert to build wealth. You just need to be consistent and patient.

You may not get 18% annually going forward. Even 12–14% can do wonders if you start early and stay long.

The investor who began this ₹10,000 SIP in the Tata Mid Cap Fund didn’t do anything fancy:

- No stock picking

- No market timing

- Just regular investing + not stopping during tough times

And that was enough to create ₹11.26 Crores.

Let your SIPs run, let time do the heavy lifting.

📌 Frequently Asked Questions (FAQs)

Q1: Can I get similar returns by investing now?

While past returns are not guaranteed, consistent SIPs in good funds still offer strong potential over 15–30 years.

Q2: Is the Tata Mid Cap Fund still a good investment?

It remains a well-managed and time-tested fund, suitable for long-term investors with moderate to high risk appetite.

Q3: What’s the minimum SIP amount I can start with?

You can start with as little as ₹100–₹500 per month. But higher amounts (₹5000+) over the long term will compound significantly.

Q4: Should I invest a lump sum or SIP?

For mid cap funds, SIP is safer due to volatility. A lump sum is better only during market corrections or with staggered deployment.

Q5: How long should I stay invested?

Ten years is the bare minimum, 15–30 years is ideal for seeing meaningful compounding.

🔻 Disclaimer

Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Past performance may or may not be sustained in the future. This blog is for educational purposes only and should not be construed as investment advice. Please consult a SEBI-registered financial advisor before investing.

VSJ FinMart is a registered Mutual Fund Distributor (MFD) and does not provide fee-based financial planning.