Overconfidence Bias: Why Your Brain Might Be Your Portfolio’s Worst Enemy

Overconfidence bias can sabotage portfolios. Learn how your brain’s false confidence increases risk and hurts long-term investment performance.

Systematic Active Equity Investing: Smarter, Data-Driven Equity Portfolios

Systematic Active Equity Investing combines data and discipline. Build smarter equity portfolios with consistent strategies and reduced emotional biases.

How Personality Influences Your Risk Appetite in Investing

Personality shapes your risk appetite in investing. Understand behavior, psychology, and traits to align investments with financial goals.

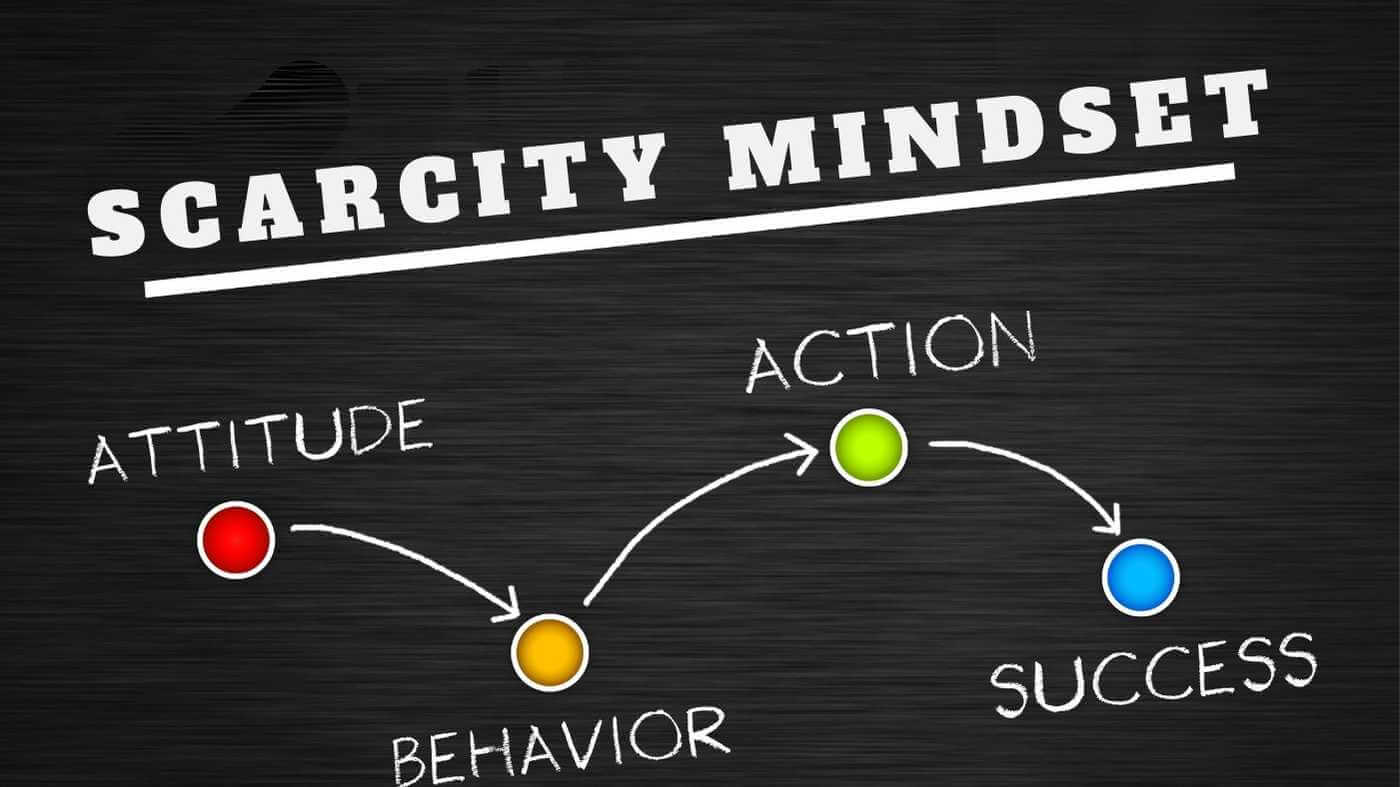

How Scarcity Mindset Impacts Financial Decisions

Scarcity Mindset limits smart money choices. Discover how it impacts financial decisions, savings, and investments—and learn strategies to shift toward abundance thinking for financial growth.

Overconfidence Bias: A Hidden Risk in Financial Advice

Overconfidence Bias can distort financial advice and decisions. Learn its causes, risks, and strategies to recognize and overcome this hidden behavioral bias in money management and investing.

Why Your Risk Tolerance Might Be Misleading You

Risk tolerance may not reflect your true investing behavior. Learn why risk tolerance can mislead and how to invest wisely.

Are You a Victim of the Sunk Cost Fallacy?

Learn how the sunk cost fallacy affects your investing decisions and discover strategies to avoid costly financial mistakes.